Via: WRAL

Do you owe back taxes in North Carolina? Your name may be on the list.

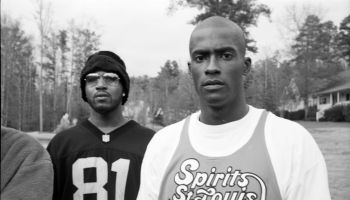

Raleigh, N.C. — On the football field, Koren Robinson was at the top of the best players’ list for his athletic skills while at North Carolina State University and with the NFL. Now, he tops another list as one of North Carolina’s top 10 tax debtors.

More than 900 people and businesses owe the state nearly $26.8 million in back taxes and are considered among the state’s worst offenders because they won’t pay, according to N.C. Department of Revenue officials.

Publishing debtors’ names on the Internet is one way the government tries to recover the money.

Robinson owes the state $497,502.96, according to the records. He owns a house in Cary, but a man who answered the door there said Robinson is out of state. Robinson called WRAL News to say that his lawyers are handling his taxes, but he declined to say why he owes so much money.

Former Mebane council member Bob Hupman owes $2.2 million in state taxes, records showed. He resigned his political seat this year amidst negative publicity and outrage from citizens like Rosa Hester.

“I think it’s wonderful that he resigned. It’s only fair. We have to pay our taxes. He needs to pay his, too,” Hester said.

Hupman didn’t respond to WRAL’s requests for comment, but friends said his taxes stem from a business he sold. They said bad investments have left him unable to pay.

A Durham resident named J. Denson owes $1.1 million, according to the records. No one answered the door at the address he has listed. In 1999, the Securities Exchange Commission went after a Joseph Denson with the same address for raising money in a Ponzi scheme.

“(These people) all received some sort of communication from the department,” said Linda Millsaps, DOR’s chief operating officer. “I think it would be fair to say we’ve made attempts to work with them and help them extinguish their liability.”

DOR began publishing a list of debtors in 2001 to expose who owed money in the hopes that the people would pay.

“In terms of getting on the list, you have to owe at least $5,000 and have an outstanding balance for 90 days,” Millsaps said.

DOR officials said they can’t discuss individual cases, but some of the names have been there for years. Those who think they might be in danger of making the list should call the revenue department and try to work out a plan, officials said.

While the debtors’ list includes more than $26 million in back taxes, the state is owed a total of about $500 million, DOR officials said. In other cases, people have worked out arrangements like a payment plan.